A Random Act of Culture

Friday, November 5, 2010 at 9:12AM

Friday, November 5, 2010 at 9:12AM This is just too good not to share. Watch it full screen.

Friday, November 5, 2010 at 9:12AM

Friday, November 5, 2010 at 9:12AM This is just too good not to share. Watch it full screen.

Tuesday, October 19, 2010 at 4:34PM

Tuesday, October 19, 2010 at 4:34PM  Very often my consulting work with clients comes around to the topic of selling and new customer acquisition. Like many coaches and consultants I get my client to describe (or create) their sales funnel. The funnel starts with a larger number of prospects coming in the top and a smaller number of new customers coming out the bottom.

Very often my consulting work with clients comes around to the topic of selling and new customer acquisition. Like many coaches and consultants I get my client to describe (or create) their sales funnel. The funnel starts with a larger number of prospects coming in the top and a smaller number of new customers coming out the bottom.

Now because I'm a CPA we have to count EVERYTHING. This includes the various parts of the sales funnel. The problem is that people want to call everyone a prospect. In order to convert a lead or an associate or a family member or whomever into a prospect you need some sort of filter, some sort of criteria. I give my clients two criteria. They must ask and get the person to answer two questions in order to classify them as a prospect.

Question 1: Is this thing (problem, opportunity, project, etc) something that you would let us help you with?

Question 2: What is your budget for this?

I like these two criteria for the following reasons:

This last point is one of the most important. Countless hours have been spent trying to close customers only to learn that those customers have no intention or ability to pay for what they want accomplished. Understand that I am not saying you have to settle price during this conversation. What I am saying is that you need to figure out whether the value your prospect places on the project is even on the same planet as the value you have in mind.

I once got into a conversation at a networking event with a prospect that seemed ready to sign on a market and feasibility study. In my mind, given everything we had talked about thus far, I pegged the project in the $15,000-$25,000 range. When I asked about the budget I was told that he and his partners had set aside $1,500-$2,000. We still closed the engagement at $5,000 but the conversation immediately shifted and I was able to temper his expectations concerning what we could provide for the money he wanted to spend.

If you want to increase the number of high value prospects coming into the top of your marketing funnel commit to start measuring those who are asked and answer questions 1 and 2.

Friday, September 24, 2010 at 11:05AM

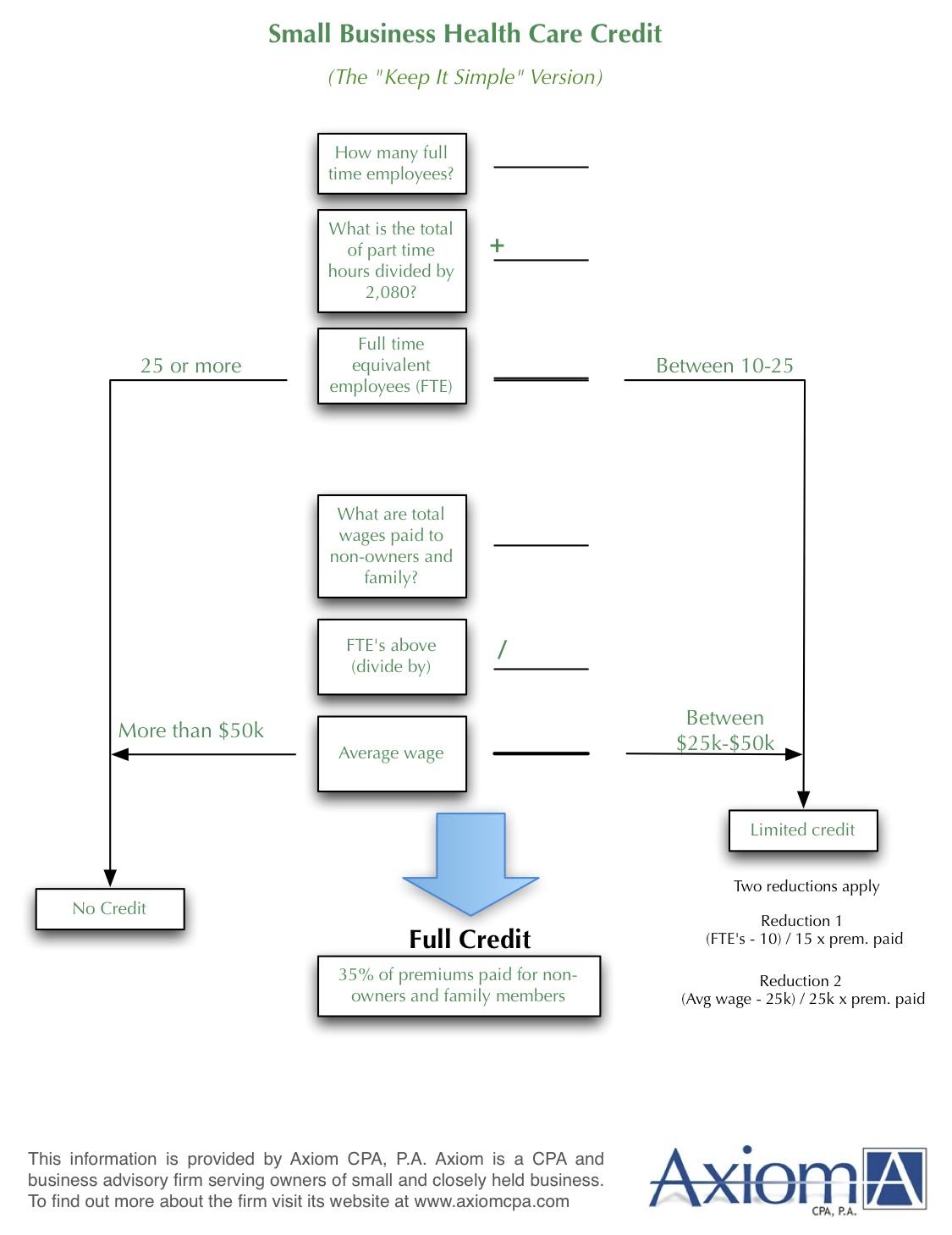

Friday, September 24, 2010 at 11:05AM  The Small Business Health Care Credit passed earlier this year offers an attractive tax incentive to small business owners. However, the credit can be difficult to decipher and several limitations may apply. To assist us in our conversations with business owners we have created an easy to follow worksheet that determines whether a business is eligible for the full credit, a partial credit or no credit at all.

The Small Business Health Care Credit passed earlier this year offers an attractive tax incentive to small business owners. However, the credit can be difficult to decipher and several limitations may apply. To assist us in our conversations with business owners we have created an easy to follow worksheet that determines whether a business is eligible for the full credit, a partial credit or no credit at all.

As with all tax legislation there are several exceptions to the general rule. If any of the following apply to your business you will need to dig a little deeper and should seek the counsel of your CPA.

One significant draw back to the new law is that business owners and family members on the payroll are not eligible. If recorded properly the owner and family members can still get a 100% business deduction for premiums paid, but they won't receive a tax credit.

Something else to remember is that at 35% the credit has roughly the same tax effect as a health insurance deduction for corporations and business owners in the highest tax bracket. For a business owner in a 25% tax bracket the credit is more favorable than the deduction, but since the employee benefit deduction must be reduced by the credit amount the benefit is only incremental

For instance a credit based on $30,000 of premiums paid would be worth $10,500 to the business owner. If the owner is in a 25% tax bracket the business deduction alone provided a $7,500 tax benefit. Don't get me wrong. Three thousand dollars is still a good chunk of money but law makers have been making this credit sound like the great answer to small business owners' problems. It provides a little relief, but once the owner and family members are excluded that relief is even less than it should be.

Download the worksheet here.

Friday, September 24, 2010 at 9:15AM

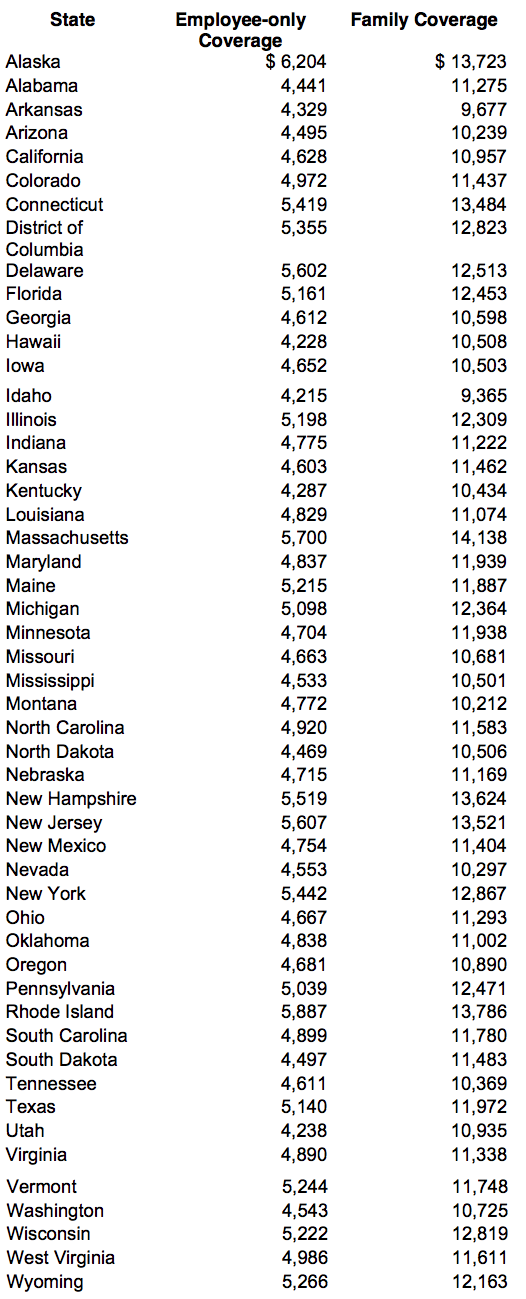

Friday, September 24, 2010 at 9:15AM Earlier this year a new law went into affect that includes a health care credit for small business owners. The law allows employers to receive a credit of up to 35% of health care premiums paid for non-owners and family members. However, if the group health insurance premium is more than a predetermined amount employers must use the lower figure to calculate the credit. These predetermined amounts are established each year on a state-by-state basis.

Revenue Ruling 2010-13 lays out the maximum premium to be used in 2010 for calculating the credit. The table below is excerpted from the revenue ruling.

Friday, September 17, 2010 at 2:25PM

Friday, September 17, 2010 at 2:25PM Pink's latest book Drive: The Surprising Truth About What Motivates Us is well summarized in this illustration by RSAnimate. Think of it as the cliff notes version meets a whiteboard while the author narrates. Quite good.